Supplemental Security Income (SSI) is a lifeline for 7.4 million low-income people in the U.S. It provides financial help to the elderly, blind, or disabled, ensuring they can afford basic needs like food, clothing, and shelter.

However, SSI has strict rules about income and resources to determine eligibility. Luckily, some assets don’t count toward these limits, making it easier for recipients to keep essential items without losing benefits.

What Assets Don’t Count Toward SSI Income Limits?

SSI Resource Exclusions

SSI allows certain items to be excluded from its resource limits. These exclusions ensure recipients can maintain basic living conditions without risking their eligibility.

- One Vehicle: A car or other vehicle used for transportation is excluded, no matter its value.

- Household Items: Furniture, appliances, and personal belongings like clothing don’t count.

- Burial Funds and Plots: Each individual can have up to $1,500 in burial funds and one burial plot.

- Life Insurance: Policies with a combined face value of $1,500 or less are excluded.

- Government Aid: Benefits like food stamps and energy assistance are not considered.

- Special Accounts: ABLE (Achieving a Better Life Experience) accounts and PASS (Plan to Achieve Self-Support) funds are protected.

These exclusions help SSI balance fairness with the practical needs of recipients.

Benefits Beyond Financial Support

In addition to monthly payments, SSI offers other important benefits:

- Housing Assistance: Free or subsidized housing for stable living conditions.

- Medicaid: Access to comprehensive healthcare services.

- Food Assistance: SNAP benefits to ensure recipients have enough food.

These additional supports significantly improve the quality of life for SSI beneficiaries.

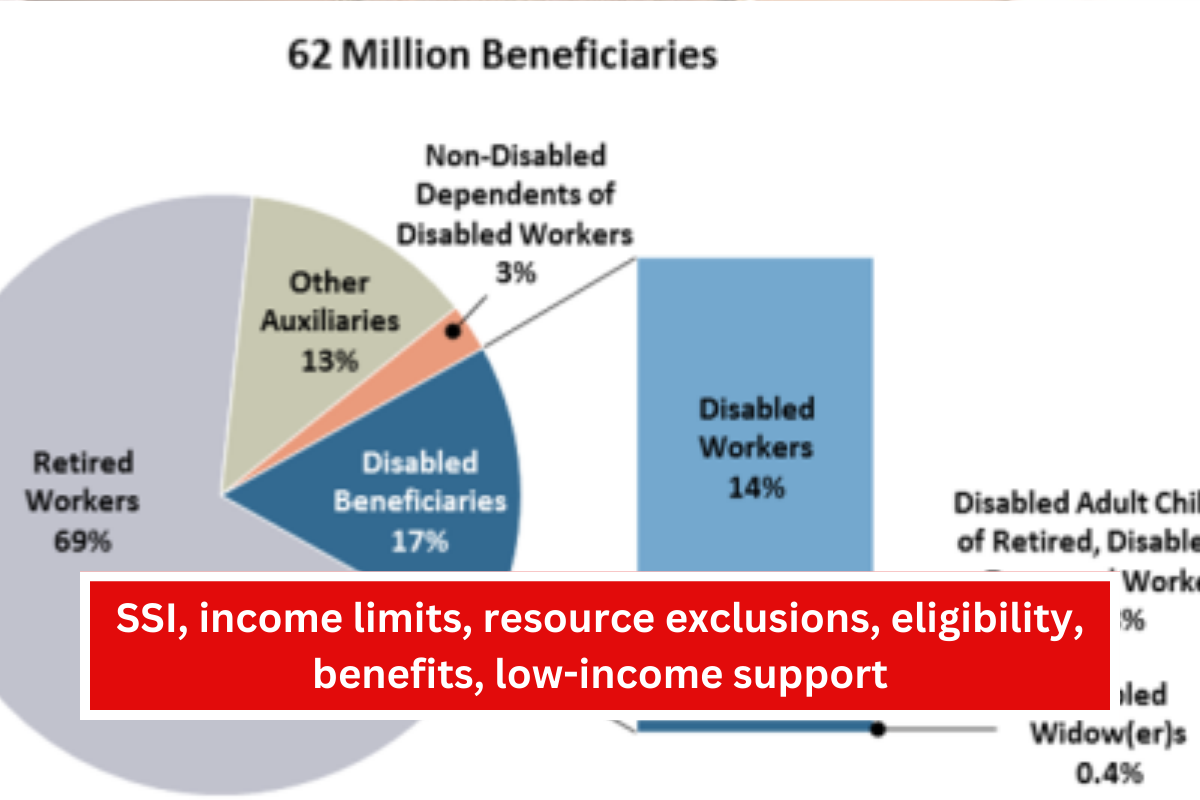

Rising Demand for SSI

The demand for SSI is growing due to several factors:

- Aging Population: More seniors are eligible for benefits.

- Disability Awareness: Increased recognition of disabilities has expanded the program’s reach.

- Rising Living Costs: Inflation and economic changes make SSI essential for many families.

Key Facts About SSI

- 7.4 Million Beneficiaries: Reflects the program’s vital role in supporting vulnerable groups.

- Growing Need: Demand is expected to rise as populations age and living costs increase.

Future of SSI

The future of SSI is a key topic of discussion among policymakers. Proposed changes include:

- Increasing Benefits: Adjusting monthly payments to match the cost of living.

- Raising Resource Limits: Updating outdated thresholds to meet modern financial realities.

- Enhanced Funding: Securing long-term financial resources to maintain the program.

SSI continues to evolve, aiming to provide better support to the most vulnerable members of society.

FAQs

1. What items are excluded from SSI resource limits?

Items like one vehicle, household goods, and up to $1,500 in burial funds are excluded.

2. What are ABLE and PASS accounts?

These are special savings plans that don’t count toward SSI resource limits.

3. How does SSI help beyond financial payments?

SSI also provides housing assistance, Medicaid, and food benefits.

4. Who qualifies for SSI benefits?

Low-income individuals who are aged, blind, or disabled.

5. Why is SSI demand increasing?

An aging population, rising living costs, and more disability awareness are key factors.